2024, A WORLD WITH $307TRN+ DEBT AND ELEVATED INTEREST RATES

This can be problematic …

Total debt across the globe in 2023 amounts to more than $307 trillion. In this article, I am going to focus on public (government) debt, which amounts to $97 trillion. What does this mean for the world, and more importantly, what are the implications where maturing debt (bonds) will have to be rolled over?

An important factor to consider is what every country’s debt is as a percentage of its GDP. The higher that percentage is, the more such a country must spend of its annual budget to service its debt, at the very least, the interest on its debt. Government debt, like business debt and personal debt, must be serviced, and the cost of that debt comes in the form of interest.

The higher the debt and the interest rate, the larger the portion allocated to service that debt becomes, and the less disposable income the individual, company, and country has. As far as countries are concerned, it means less money to spend on healthcare, education, social welfare, etc.

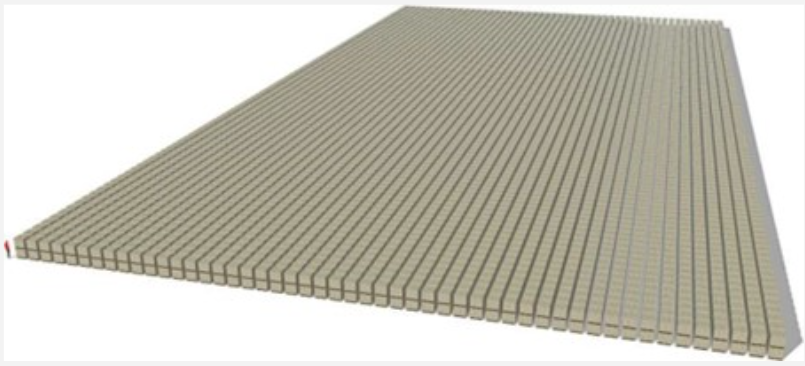

Let’s get a bit of perspective on what $1 trillion looks like. The illustration may be a bit corny for some, but it does illustrate the quantum rather nicely. In the bottom left figure, the pile is made up of 100 packets of $10 000 each. This represents $1 million.

In the illustration above, on the right-hand side, the same configuration is multiplied to amount to $100 million. This looks a bit more impressive.

To get to $1 billion, 10 of the above stacks need to be put together, as can be seen below. This is now becoming impressive.

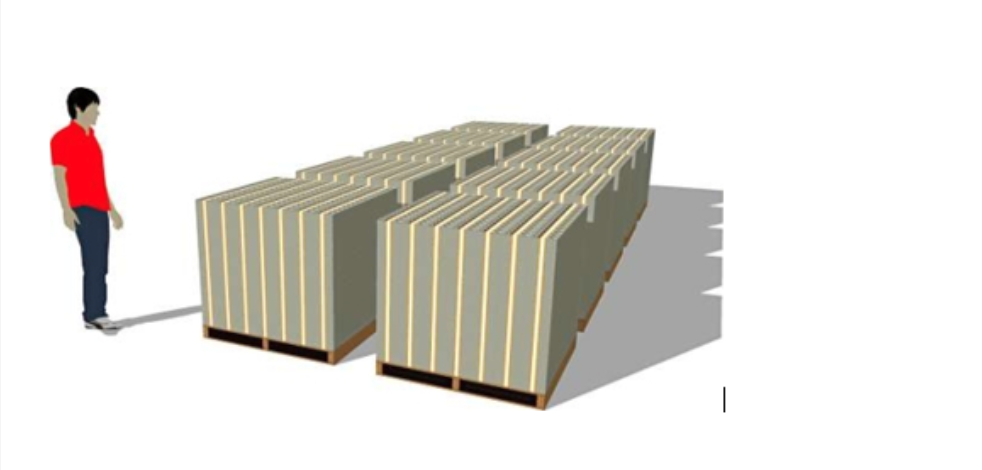

$1 trillion is simply mind-blowing. Notice the size of the man at the bottom left-hand corner of the pile illustrated below, and note that the piles are double-stacked; they are no longer single pallets.

Now times the above by 33 to get a perspective of the US current debt situation, and for it to really make sense, times that by 20 to understand how much that is in rand!

It is easy to throw around figures of trillions of dollars, but not so easy to comprehend how much it really is. The world has a serious debt problem …

Although the pandemic contributed to the current sorry state of world debt, the graph below shows that growing debt was evident from much earlier on, with public debt escalating aggressively from the ’80s onward. Total debt at the end of 2023 is off the chart (the chart indicates values as at end-2022) at $307+ trillion thanks to the fight against inflation (rising interest rates and issuing bonds) and the funding of recent wars. Consumers and corporates have also become more indebted due to Covid’s limited economic activity, followed by inflation and rising interest rates.

Why does global debt matter?

Global debt per se is not such a big problem. The problem is caused by the cost of that debt and the disposable income a country (or an individual or a company) has. The disposable income of a country is measured in a global debt-to-GDP ratio, and if this ratio is out of tilt, problems are bound to crop up. Currently, the world’s total debt-to-GDP ratio is a staggering 336%. Public (government) debt amounts to approximately 40% of total world debt, placing it at approximately 134% of the debt-to-GDP ratio.

In the table above, it shows that the top 10 countries in the world make up 81% of the world’s gross debt to GDP. Approximately another 170 countries contribute towards the balance of debt. Many of these 170 countries have poor economies and high debt and will suffer the most in the event of a recession or a financial crisis.

The five largest economies in the world make up more than 50% of world GDP. It therefore matters what the debt status of those countries is and what they pay for that debt. Allocating too much of the free reserves to settle or fund debt can lead to a recession that will impact the rest of the world. Who are these countries, and what is their debt position?

It is concerning to see that the world’s largest economy (US) has a debt ratio of 123% of its GDP. That technically means that the US is underfunded by 23%. One way to fund this shortfall is to issue more bonds. In basic terms, a bond is a loan by the government issued over a specific period with a fixed interest payment. The interest payments are generally paid every six months.

Currently, there are $26.3 trillion in US Treasury Securities outstanding. This has two implications. Firstly, the interest has to be paid on these bonds, albeit probably at a lower rate than current interest rates. Secondly, upon maturity, the capital of these bonds must be repaid to the lenders. If there is not sufficient capital to repay these bonds, new bonds will have to be issued to fund the repayment. Given the current high interest environment, new bonds will come with much higher coupon rates (interest), which will place even more pressure on the current debt levels.

Of the $26.3 trillion outstanding securities, roughly $4 billion are 30-year bonds. The rest are payable in less than 10 years, many with payment dates of one, three, five, and seven years. This may be problematic, especially in a higher interest rate environment …

What the above means is that if new bonds are issued, and they get issued at higher coupon rates (interest), competing markets, which include emerging markets, will have to issue bonds at higher coupon rates as well, thereby increasing their debt burden. This becomes a downward spiral into a dark debt pool, which little good can come. The only way to prevent this for emerging markets is to reduce debt and improve GDP. Both of which SA is bad at achieving …

Printing money

The comment is often made that in order to pay debt, a country can simply print more currency. This may work for developed countries that issue bonds in their own currency, although their currency will probably reduce in value depending on the amount of currency “fabricated”. This is what happened to Japan (which still has a USD debt-to-GDP ratio of over 250%). Its problem is aggravated by the spending patterns of Japanese consumers, who do not like debt and mainly deal in cash. Its banks have been in negative interest territory for more than a decade. An ageing population and structural challenges add to its debt challenge. However, Japan has shown that high debt-to-GDP levels are possible to live with for very long periods. Maybe this is the new norm?

SA does have an advantage compared to many other countries, especially emerging markets. By far, the majority of its bonds (approximately 85%) in issue are rand-denominated. This takes away currency risk and pegs the debt value since it does not have to worry too much about currency devaluation.

If push comes to shove, SA can print currency to settle the debt. This will depreciate the rand, but it does reduce the risk of a payment default.

The world is turning out to be more interesting and challenging by the day. With debt, wars, and people who don’t know who they are or who/what they would like to be, it does make for interesting times …

Key questions

Will we see a recession in 2024? The verdict of economists is split almost 50/50. In other words, maybe, maybe not. This means the odds for decent returns are the same.

Will we see interest rates dropping? The odds are in favour of reducing interest rates, in which case bonds will provide stellar returns.

Will geopolitical tensions escalate? Given what is currently happening in the Red Sea, it seems likely that they will. Watch the disruption of freight and delivery problems carefully, with many freight ships now avoiding the Suez Canal and the Red Sea. This may cause shortages and price increases (remember what freight disruption caused during Covid?), which will lead to higher inflation. As we know, if inflation increases, interest rates follow …

What to do

In times like these, investment strategies become more important than boring times when markets are in either bull or bear territory with known outcomes. The world today is unpredictable, and it seems like today changes happen much quicker than a couple of years ago.

Choose your managers and advisors well. Protection of capital and taking advantage of current trends are of equal importance. Don’t lose out on potential exponential returns by avoiding new trends and ideas by only being in cash but at the same time, don’t get caught with your pants down by betting your whole hand …

Stay safe, and a blessed festive season to all.