IS AN ANNUITY WORTH IT FOR HIGH-INCOME EARNERS?

When running the numbers, the outcome favours the RA as a base investment. Here's why …

Reader question:

“Is an annuity really worth it for high-income earners? It is, of course, not tax-free, as is commonly touted. Eventually, you do pay tax, except on the first R550 000.

If you have other income streams, you may very well pay 45% of your income from the annuity anyway. You just delay the tax on a fund with inferior growth.

So why would you want an annuity when you can get much better growth in a fund with 100% offshore exposure, which Regulation 28 forbids in annuities?”

This question always attracts much debate. Tax-sensitive investors tend to be against annuities since the income derived from annuities (compulsory annuities) is fully taxed. Voluntary guaranteed annuities are more tax-friendly since a part of the monthly income paid is deemed to be repayment of capital, thereby reducing the average tax rate substantially.

I am not sure if you are referring to pre-retirement retirement annuities (RAs) or post-retirement annuities (living annuities). I assume your question relates more to living annuities even though you refer to Regulation 28 (which does not apply to living annuities). Regulation 28 only applies to pre-retirement products. My comments will thus be more living annuity-centric, with some reference to compulsory life annuities. I will, however, also delve into RAs a bit as well.

At the outset, I want to state that unless you have a provident fund, you have no choice but to purchase an annuity with at least two thirds of the proceeds of your pension fund or retirement annuity.

Here, you can choose between a living annuity, where you can annually choose your income as a percentage of the living annuity value on the anniversary date of the annuity, or a life annuity, which provides a guaranteed life-long income.

If you have a provident fund, you are entitled to the full amount in cash, subject to retirement tax tables that can ramp up to 36%. You can also choose not to take the cash and opt for an annuity where you will be taxed monthly.

As you rightly stated, the first R550,000 of the cash commutation will be tax-free, irrespective of whether the proceeds are from a provident fund, a pension fund or a retirement annuity. It is important to note that the R550,000 is aggregated across all your retirement funds and not per fund. Investors often forget about the amounts they took in cash when they changed jobs and accessed their retirement funds in the past. Past withdrawals, including partial withdrawals, count towards the R550,000.

Invest in annuities or voluntary funds?

In my opinion, it should not be a choice between an annuity or voluntary investments that provide your retirement income. One should have both for various reasons. What percentage you allocate to voluntary versus compulsory depends on your circumstances. Bear in mind that you will have to decide on the split many years before retirement because capital accumulated in retirement funds will have to be placed into some sort of compulsory annuity when you retire unless the fund is a provident fund, as I previously mentioned.

My ‘thumb suck’ recommendation is to split the funding of compulsory funds (retirement funding) and voluntary funds such as cash, unit trusts, shares and exchange-traded funds (ETFs) down the middle to try and achieve a 50/50 split the day you retire.

Why do I suggest this?

One of the most important financial planning strategies and objectives must be to optimise tax. It makes perfect sense to structure one’s portfolio and invest in cash until the interest generated becomes taxable. It also makes sense to ‘draw income’ by selling units (unit trusts or ETFs) or shares to the point where income tax is reduced to single figures, especially where your starting tax is above 30%.

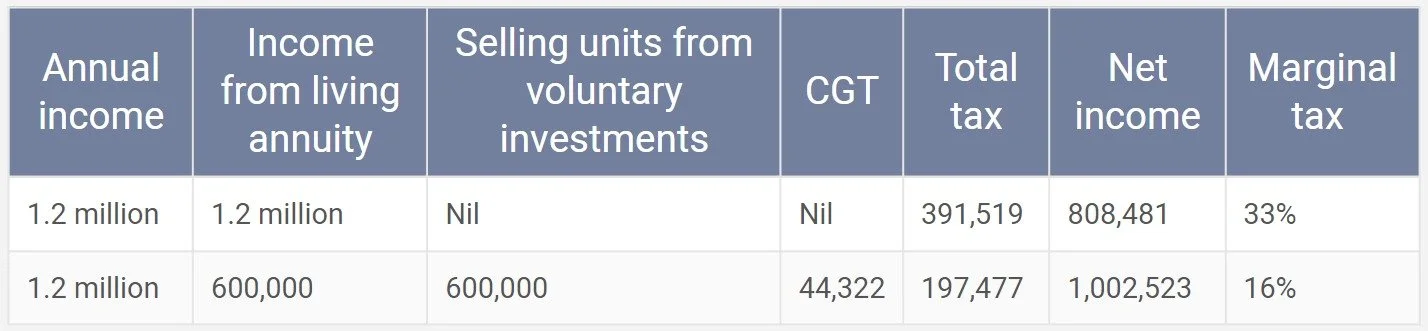

Attracting capital gains tax (CGT) is more tax-efficient than pure income tax, like drawing income from fully taxable annuities. Tax is calculated on a ‘total taxable income’ basis. See the table below as an example (assuming a total investment value of R30 million and CGT base cost of 50% of the investment value. Drawdown at 4% per annum):

The above figures are very simplistic, but in theory, this simple example indicates that the income level can be reduced from 4% per annum to around 3% per annum, and that makes a huge difference in the sustainability and longevity of the overall investment. Sure, the figures would look even more impressive if all the investments were voluntary. However, there is a tilting point where it makes absolute sense to have compulsory funds as well as voluntary funds. In most investors’ cases, they will have compulsory funds due to historical contributions and their past conditions of employment.

Since most people will end up with an annuity of some sort, bear the following in mind in favour of living annuities:

Regulation 28 does not apply to living annuities. This effectively means that you can invest 100% offshore. Some administrators limit offshore exposure to 45%, but those are institutional limitations, not regulatory limitations. Whether it is the right thing to do is another debate; in my view, it probably is not. There are many factors to consider, of which the most important are the level of income you draw, the price at which the offshore market is when you invest, and the exchange rate at that point. The sequence of return risk can kill your investment if you get this wrong.

Living annuities fall outside your estate. This can mean a saving of 20% to 25% estate duty on your investment value, depending on the size of your estate.

The returns within living annuities are not taxed and do not incur CGT. Voluntary funds are taxed via CGT and income tax, where interest and rental income are earned.

Living annuities cannot be attached by creditors. This may sound trivial, but this is important for many business owners and professionals.

There is no reason whatsoever for living annuity returns to be lower than those of voluntary investments. As the investor, you choose the investment portfolio of a living annuity. Underperformance cannot be blamed on the living annuity but rather the investment portfolio choice and the income level you draw …

In case you referred to pre-retirement funding in your question, I will make some short comments about RAs that also apply to other retirement funds.

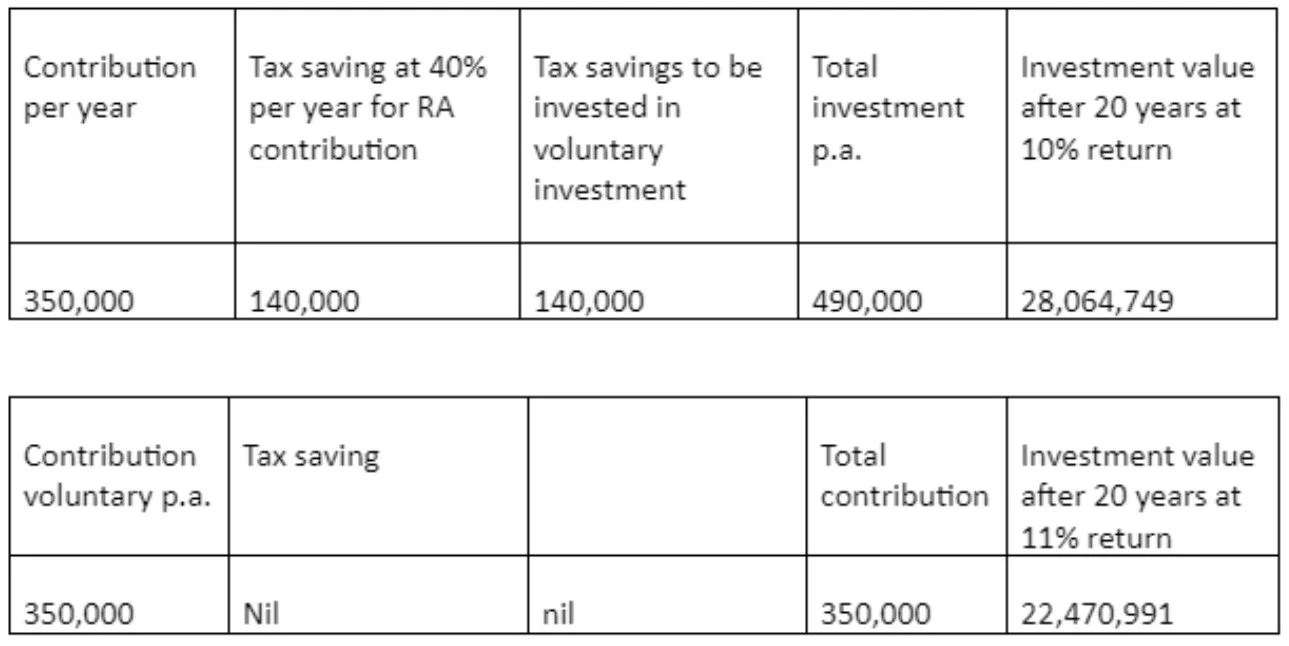

RAs also fall outside your estate and are therefore not estate dutiable. Returns within RAs are tax-free, and contributions are tax-deductible up to the 27.5% limit of taxable income limited to R350,000 per year. This is a huge benefit, even if future retirement income generated by these funds will be taxable.

Not many retire with the same income level as they earned while working. This means you may pay a high tax rate of 20-30% when retired while you benefit from a 40-45% tax deduction while contributing towards the RA. If you invested the 45% saving in a voluntary investment, the combined return will be unmatched, and the longer you did it, the larger the benefit will be. From a cash flow perspective, it is neutral as far as the net contribution is concerned.

Consider the following, assuming you have a maximum of R350,000 per year to invest:

The above results are self-explanatory. Even if 1% enhanced annualised returns can be achieved due to more offshore exposure that one can achieve in voluntary funds, the outcome still favours the RA as a base investment, even with the constraints of Regulation 28.

Also, bear in mind that voluntary investments will attract CGT when adjustments are made to the portfolio, and income tax will be attracted on interest earned, real-estate investment trust returns, and bond yields during the duration of the investment, which will detract from the end figure.

As a parting comment, I would like to point out the attractive rates currently offered by guaranteed annuities. Both compulsory and voluntary annuities at the moment offer rates that cannot be sustained if drawn against a living annuity. Rates above 10% guaranteed for life for elderly people are not a bad option, especially if legacy and the transfer of wealth are not a high priority.

I hope that I have answered your questions sufficiently. You are welcome to contact me should you have any further questions.

The bottom line is that the best solution is to construct an investment portfolio that will provide the best outcome as far as returns, tax and estate duty are concerned. This solution will look different for different investors. Consult a suitably qualified advisor to help you optimise your overall portfolio.

Happy investing.