THE FEE FALLACY: WHY LOWER FEES DO NOT GUARANTEE BETTER RETURNS

A closer look at how management, admin and advisor costs shape your actual investment returns and why higher fees sometimes win.

Over the years, the fee debate has become more prominent. This debate, and the increased focus on fees, are good for investors, and it has placed pressure on providers, administrators and financial advisors to reduce fund management fees, administration fees and advisor fees.

Low-cost fund providers often cite that fees between 3% and 3.5% per year will significantly reduce portfolio returns. Although the basis of this comment holds true, we need to understand how a figure of 3.5% is even possible, because this is most certainly not the norm.

The statement also only holds true if different fees are charged for exactly the same investment solution, then the cheapest fund will, without doubt, outperform.

Generally, there are three levels of fees. However, only two of these will impact the published returns of funds. The different tiers of fees can be explained as follows:

Tier 1: Fund manager fees

These are the fees raised by fund managers to manage funds. Fund manager fees vary widely and can include performance fees where fund managers share in the profits and losses when funds outperform or underperform their benchmarks. When funds generate exceptional returns, performance fees can elevate fund manager fees to levels that make investors uncomfortable. However, over the years, pressure mounted for active managers to move away from performance-based fees. Many have succumbed and bowed to the pressure and introduced “clean classes” without performance fees. Some fund managers, however, do still charge performance fees.

I do not oppose performance fees as long as the calculation remains fair and investors benefit during periods of both over- and underperformance. Choosing an appropriate benchmark for performance comparison is essential.

Generally, actively managed funds are more expensive than passively managed funds. Due to the advantages of volume, large funds tend to be cheaper than small funds because of lower trading costs and other fees. Equity funds are also more costly than bonds and income funds, mainly because more resources are needed to conduct the necessary research for equity funds. Fees range from around 0.25% for passive funds to 1.5% for active funds without performance fees. Offshore passive trackers are approaching zero fees as we speak.

Performance fees can raise fund manager fees above 3%, but this is uncommon. That said, some funds (including one that we use regularly) currently exceed the 3.0% threshold. Conversely, underperformance can also significantly lower fees. It is typical to see the same fund offered with different fee classes. Generally, these classes relate to how fees are charged within the funds.

NB! Published returns are net of fund manager fees. Fund manager fees are deducted at source and all return figures quoted are the returns after fund manager fees.

Tier 2: Administration fees

These are the fees charged by investment platforms that provide access to multiple funds. Some platforms do not charge administration fees on their own funds offered through their platform. The size of the investment affects the fees, which generally start at 0.5% for investments up to R 1.5 million and decrease for larger amounts. Some platforms aggregate investments of investors, which reduces their administration fees.

NB! Administration fees must be deducted from published returns to determine the net return of the investment.

Tier 3: Financial advisor fees

Advisors may charge initial fees as well as ongoing fees. These fees are negotiable and while some advisors prefer to charge a higher initial fee and lower ongoing fee, others opt to waive the initial fee and charge a higher ongoing fee. Fee models depend on the value offering and business models of the respective FSPs.

Some advisors, like ourselves, charge initial planning fees based on time spent, as well as ongoing fees based on the investments under their guidance for continuous advice and strategic portfolio management. The average fee that impacts investment returns varies significantly between advisors and can be as low as 0.25% for large investments, with a regulated maximum fee of 1.0% per year. For the purposes of this article, I will use an advisory fee of 0.75%.

NB! Advisor fees must be deducted from the returns published by fund managers.

The net return that investors receive will therefore be:

Published returns – administration fees – advisor fees = net return (client experience)

Fees = fund manager fees + administration fees + advisor fees

Returns displayed on administration platforms are net of fees and reflect the actual values and returns of investments.

If we consider an investment of R 5 million, then a fair fee assumption for a typical medium to high equity portfolio will be:

(Fund manager) 1.5% + (admin) 0.35% + (advisor) 0.75% = 2.6%, of which 1.1% must be deducted from the declared fund returns. When passive funds are used, the fund manager fee will be lower, resulting in an overall cost of approximately 1.5%. However, the net outcome will depend on the actual fund returns , not the fees.

Let’s get down to the nitty-gritty and see how “low-cost” funds’ returns compare to “high-cost” funds.

In a previous article, I mentioned a provider (whom I will refer to here again), and they complained about my article. The figures I quote are found in the public domain for anyone to verify. The figures I refer to were obtained from Morningstar’s report of 1 October 2025, and on the website of each mentioned fund.

If a company or fund manager wants to comment about others’ fees, then surely they must take it on the chin if someone points out actual returns and actual fees, not true?

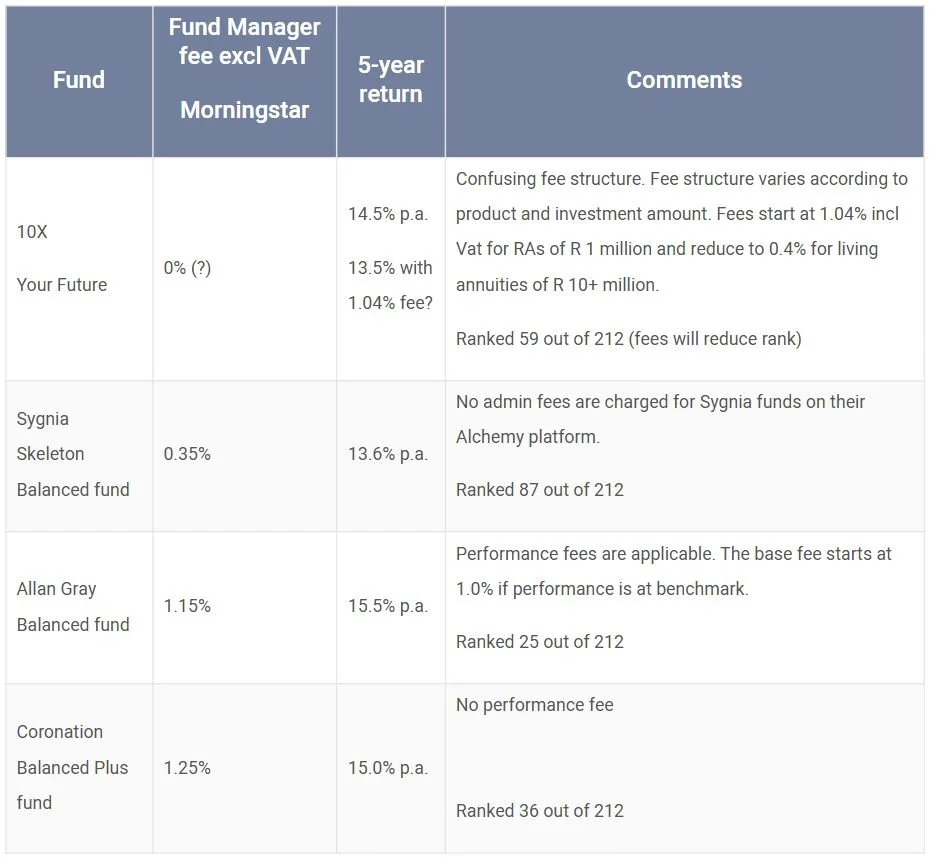

To keep it relevant and not be accused of being selective when choosing funds to compare, I selected four funds:

Two “low-cost funds” namely 10X’s Your Future fund and Sygnia’s Skeleton Balanced fund. I thought that these funds are appropriate since these are probably the two best-known “cheap” funds in the market and also the two companies that speak out the most against fees and support the passive investment style.

Two “high-cost” funds namely Allan Gray Balanced fund and Coronation Balanced Plus fund. I chose these funds because they are the most significant actively managed funds in the multi-asset high equity space and household brands.

I did not embark on selective fund selection. I did, however, use our investment house view when I compiled a portfolio as an example to illustrate fees.

See the diagram below that illustrates the fees and five-year returns of each fund. Five years is an appropriate time horizon for funds in the high equity space (Balanced funds)

From the above, we can conclude that over the past five years, both the “expensive” funds have outperformed the “cheaper” funds. All four funds performed well.

What happens if we include administration and advisor fees? One would expect that advisors provide value that justifies their fee. Value can be added at different levels, not solely through performance. Honestly, be cautious if advisors offer their service based only on the promise of superior performance. If performance is the main focus, volatility is likely to increase as well, due to the ongoing pursuit of higher returns.

See my previous article about investor behaviour.

Instead of maximum returns, we rather focus on appropriate returns but that makes for a different article.

One of the challenges of passive investing is the inability to diversify properly. All the funds that I compare in this article are bound by Regulation 28 limits. For all investments outside retirement funds, more flexibility makes sense and the following illustrations indicate the benefit of blending funds to achieve a better outcome.

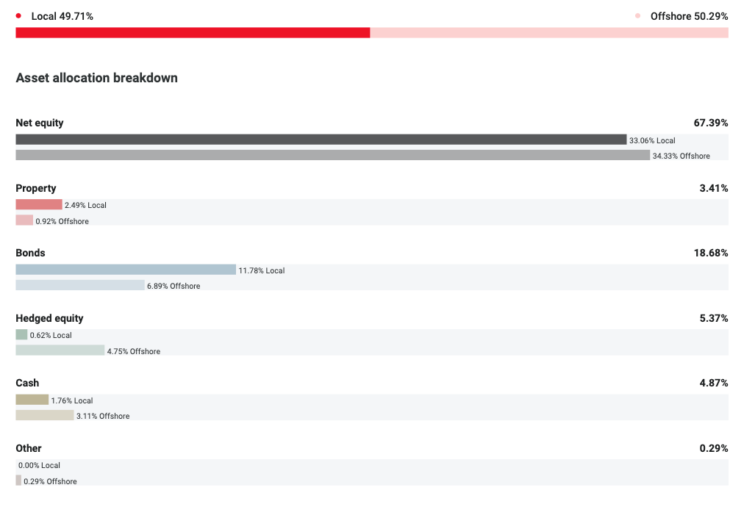

The portfolios below are from our house view and are for illustrative purposes only. Our clients will identify the funds, which I have blacked out. I have taken five funds, which includes the Allan Gray and Coronation Balanced funds and added three more to tilt offshore exposure slightly higher and included funds with alternative strategies. The result is a portfolio that is moderately aggressive (around 65% equity exposure) and approximately 50% offshore exposure. This is a typical living annuity portfolio where the investor is drawing between 4% and 7.5% income.

The table below indicates the returns of the illustrated portfolio and shows a return of 16.32% per year over the past five years, net of all fees. Considering that the portfolio will be active for 30 years, the enhanced returns are substantial. The portfolio also assumes that the portfolio would have been static over the past five years, which is highly unlikely. Portfolios should change as circumstances, needs and markets change. That will not happen in a single rules-based passive fund.

The table below shows how the portfolio compared to the Multi Asset High-Equity sector over 10 years. Once again, the table assumes a static portfolio, which would not have been the case.

The table below shows all the fees. Currently, one fund is increasing the overall fee because of the existing 3.41% fee, which includes the performance fee charged by the manager. Despite the fund’s high fee, the total cost of 2.92% remains lower than the ‘regular fee’ of 3.5% that 10X frequently mentions.

I don’t mind this high current fee of this particular fund manager if one considers that over the past 12 months the fund returned 28.62% and 23% per year over three years net of the fund manager’s fee.

Would you rather pay 0.5% manager fee and receive 14.6% (13.6%?) net or pay 3.41% and receive 28.62% net of the fee? I know which one I prefer and that is why it is in our client’s portfolios.

Conclusion

Fees matter, but lower fees do not guarantee you better returns.

At the end of the day, you, as the investor, must decide how much you are prepared to pay for the service you receive. Service goes beyond only fees. Service is about planning, constructing appropriate portfolios using uncorrelated funds, and keeping you on track to meet your financial goals, as well as guiding you through life’s transitions. Considering this, then 0.75% advisory fee sounds like a bargain compared to 0.8% just to access a single “not-so-cheap” passive fund for a R5 million living annuity.