THE TWO REALITIES THAT DESTROY WEALTH DURING RETIREMENT

There are two occurrences that have the potential to ruin your retirement. Manage these well and you will be assured of a secure retirement.

During the wealth accumulation phase (en route to retirement) and the wealth distribution phase (in retirement), investors are subjected to the same investment challenges. However, there is a particular devious investment occurrence that causes devastation to retirees when one gets it wrong and unfortunately, there is not much you can do about it because it is unpredictable…

The one thing that applies across the board is that we have no idea what returns are going to look like over an investment period. We may be able to reach some conclusions of what returns could (should?) look like over a 20-year period considering various investment portfolios. In this scenario past returns do have some resemblance to future returns. What the returns are going to look like every year, however, is all but impossible to predict especially where growth assets are part of an investment strategy.

If the objective is to grow your investment to a certain value over say 20 years, it is irrelevant in what order the returns on your investments are achieved.

Whether the first five years provide negative or positive returns followed by multiple years of positive or negative years or a mixed bag of returns is totally irrelevant to the final outcome as long as the annualised returns are the same over the period. The average return per year you receive is what matters irrespective of in what order returns were achieved.

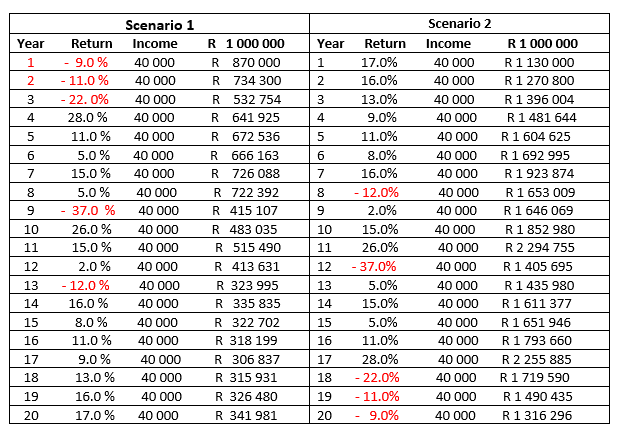

See the table below as an example: Scenario 2 returns are in reverse order of scenario 1 resulting in the same annualised return of 3.9% per year in both cases.

From the above, we can conclude that it is irrelevant in what order returns are achieved if the objective is pure capital growth.

Now let’s use the same assumptions as above but assume an annual drawing of R40 000 as income. Suddenly the order of returns becomes a crucial component in capital preservation.

The above results show that the biggest challenge to capital preservation when drawing income against an investment portfolio is the sequence of returns, especially in the first five years of an income-paying investment like a living annuity. Even though the underlying annualised returns are the same in scenario 1 and scenario 2 over the 20-year period, the way they were achieved determines the sustainability of the investment.

I have purposefully used a low annualised return in my explanation. The above calculation has one major flaw namely that a static income figure is used. Inflation was ignored. Inflation – the second demon.

Don’t let the above table in any way instil a false sense of security within you leading you to believe that a low annual return will suffice.

By increasing annual income by inflation, capital preservation becomes a major challenge. Unless a return can be achieved that is equal or greater than income + future escalations capital will be depleted. The return requirement is not a static figure. Consider the following table with different income and escalation requirements:

The above figures show what returns will be required every year to preserve capital for 25 years given the different objectives. We all know that investments do not provide returns in a consistent positive pattern unless they are guaranteed. If you are lucky and achieve returns in sequence as indicated in scenario 2 in the previous table where they are substantially higher than what is required in the first five years, then you may be off to a good start. If, however, returns are achieved as in scenario 1 you have a very serious problem in retirement.

So how do we protect an income-paying investment portfolio against capital destruction considering that returns are by no means guaranteed and even less so projectable?

Some strategies to consider:

Draw the minimum income of 2.5% until the portfolio has grown by at least five years’ worth of annual income then keep income below 4% per year. It may be a good idea to take your one-third commutation value and invest in a five-year retail bond depending on the prevailing yield. This will enable you to reduce your living annuity drawdown.

Supplement retirement income via voluntary investments and rental income. Try and plan your investments so that you have 50% investments in voluntary funds (a rental property can be considered as a voluntary investment in this case) and 50% in compulsory funds at retirement. Flexible income options can be a saviour.

Change your income to a drawdown base (draw less than what the previous year’s returns were) as opposed to maintaining a real income (inflation tracking). The starting income remains crucial, keep it as low as possible for as long as possible.

Consider guaranteed life annuities for at least a portion of your investments in you require an income of 6% or more from your investments.

Here are some “dos” and some “don’ts” that you can consider that may improve your chances of a more sustainable retirement investment portfolio:

Do:

Consider a life annuity. Income is guaranteed for life and escalations are built in. Joint lives can be registered which guarantees an income for life for the annuitant and their spouse/partner. The downside is that capital dies with the annuitant/s. Should you want to bequeath funds of your annuity to a beneficiary it cannot be done unless it is backed by life assurance (which does not necessarily get underwritten). Life annuity rates favour older people and men over women since women outlive men (sorry gents…). If you are over 70, a life annuity may not be a bad idea and living annuities can be switched to life annuities (but they cannot be switched back). This is the best “feel good” option as long as you have sufficient voluntary funds to provide for unforeseen expenses and inheritance.

Diversify your living annuity portfolio to offer an above-average chance to achieve the required returns. The main objective must be to beat inflation handsomely by at least your income requirement. Speak to an investment professional to assist you with this.

In order to enhance the probability to achieve a sustainable living annuity adopt the following two strategies within your living annuity:

Create an income “pot” where funds are placed in a money market fund within your living annuity. Sufficient cash for between two and three years of income should be allocated to this fund and income should be paid from only this fund until it is depleted. The fund can be topped up from time to time from funds that perform well over particular periods. This strategy will eliminate the sequence of return risk of the first three years of retirement. Historically growth funds rarely provide negative returns for periods longer than three years so overall this strategy should reduce the sequence of return risk. Some actuaries and investment professionals will disagree with this strategy. There is no doubt that this strategy provides more peace of mind than a high-growth portfolio from where you draw an income during turbulent markets.

Invest the balance (after the cash pot allocation) in a growth portfolio. Always bear in mind what effect the sequence of returns has on a portfolio that needs to pay an income. The more volatile a portfolio is the higher your downside risk is when you draw income. Offshore investments add to the volatility of an investment portfolio. Offshore investments are fantastic for long-term growth portfolios. Less so for income-paying investments like living annuities. The higher your income requirement is the lower your offshore exposure should be in a living annuity. See my previous article regarding optimal offshore exposure in living annuities and remember that the rand sometimes also appreciates, it is not a guaranteed downward spiral into Zim dollar status even though we are feeling very bruised in SA at the moment… When the rand does strengthen and the SA market rallies, offshore bias living annuities are in for a hiding. Many investors followed the advice at the start of Covid to move living annuities offshore aggressively. The sequence of returns of offshore rand-based investments over the past three years was completely on the wrong side of the curve. Unfortunately, many of those investors now have to adjust their standard of living…

One should however always maintain at least 25% offshore exposure in your living annuity irrespective of the income you are drawing. If you draw the minimum income of 2.5% then exposure can be increased north of 60%. All off course dependent on your risk tolerance.

My comment about offshore exposure in living annuities is not because I am pro-SA investments. It is a risk strategy where one should have the bulk of your income-paying assets in the currency that you live in irrespective of where you live. Currency fluctuations are one of the biggest contributors to volatility across the globe.

One can also opt for a hybrid-type annuity and split your annuity to include a living annuity as well as a life annuity in one annuity. This provides you with the peace of mind of a partially guaranteed income as well as the flexibility to change your income on the living annuity part as well as the ability to nominate beneficiaries on the living annuity component of the annuity.

Try and achieve an investment portfolio where 50% of your investments are voluntary funds (unit trusts, shares, ETFs etc.) and 50% are compulsory funds the day you retire. This offers income flexibility and the ability to reduce your living annuity income during difficult markets. It also provides access to emergency funds when life happens.

Don’t:

Invest too much in cash. Cash cannot beat inflation over extended periods.

Draw too high income from your living annuity. The general rule of thumb is to draw 4% or less per year to improve your chances of capital preservation.

Switch your growth portfolio to a more conservative portfolio after a market correction or during volatile times (like we are currently facing).

Invest in promises of good returns. Remember the old saying, if it sounds too good to be true, it probably is… Invest your hard-earned pension proceeds with reputable companies. Forget what the Joneses say. Everyone always tells you their good stories, no one boasts about their failures. The current crypto craze is a point in case. Billions have been lost and stolen but everyone talks about their “profit”. Time for speculation is over once you retire…

Take too much exposure to offshore assets as explained above.

In summary

Irrespective of whether you are accumulating wealth or about to let your money start working for you, decent inflation-beating returns are necessary. However, the investment strategy of someone building an investment portfolio and a person about to retire should be different since the sequence of returns has so much more of an impact on investments that need to provide income…

That concludes my story. I hope that it will resonate with some pensioners but more so with people who are about to retire.