LIVING ANNUITIES: HOW TO TACKLE THE OFFSHORE INVESTMENT CONUNDRUM

Offshore exposure in these funds should be approached differently than in voluntary investments.

Over the last couple of weeks, the old-age debate about offshore investing versus local investing raised its head again, leading to many comments and much debate.

I also received some comments and questions from readers about my previous articles, which I wrote after Covid and following the rand collapse in March 2020: Living Annuities: Be careful, too much offshore exposure can hurt you and, before that, The optimal offshore exposure in a living annuity.

As an advocate for offshore investments, I have guided all my clients to have offshore exposure. Most have over 50%, and some even have 100%. The only exceptions are those who solely invest in a living annuity and draw a significant income.

All my clients with voluntary investments have 60% and higher exposure to offshore funds. Conversely, clients with only living annuities and drawing above 7.5% have less than 40% offshore exposure. Why this difference?

Limited exposure in living annuities

It is simple. When drawing an income from your investments, you must limit volatility. As much as I like offshore investments, they are the most volatile asset when measured in rand.

A reader emailed me and challenged my previous article written in September 2021, which I believe he misread. He asked me what my opinion was now that the rand has depreciated to R19.00 from R14.30 at the end of 2021. The reader asked if I still maintained my opinion that offshore exposure should be limited in living annuities.

My response to him was, “Absolutely!” Especially when the rand is in a state of undervalue. Let me explain and move back in time to Covid and, in particular, March 2020, the time that prompted my article with a similar theme to this one.

In March 2020, the rand depreciated to R19.00+ to the USD (similar to where it is now). At the same time, articles were rife with recommendations to take your money offshore. Some suggested cashing in your retirement annuities because of the Regulation 28 restriction of 45% offshore exposure and investing in living annuities with 100% offshore exposure. I commented that I thought this was reckless advice and that investors could permanently lose capital.

How exactly did things pan out after 2020?

To simplify things, I’d like to focus only on the currency and ignore market movements. Some may argue that the offshore market performed well post-Covid and cannot be ignored. I would like to make two statements about this view: first, only selected US stocks (tech online trading linked stocks, in particular) performed well, and second, the SA market outperformed most markets due to the increase in demand for resources.

So, if anything, an SA-biased portfolio would have done even better during the year following the Covid outbreak. Since then, the S&P 500 has done very well. But like I said, let’s forget market returns.

For people who invested in 100% offshore living annuities in March 2020 (and there were many), the following applies:

By April 2021, the rand had strengthened to R14.50. That equates to a portfolio loss of more than 23% in a single year. Add a drawdown of, say, 7%, and the loss increases to 30%. Remember, if the rand strengthens, your offshore investments lose value in rands. To make back your loss of 30%, your portfolio had to grow by 43% the following year.

It gets worse. The 7% that you drew starting in March 2020 must now increase to 10% because of the reduced portfolio value (7% in 2020 + 43% loss = 10.01%) to break even. If your income must increase with inflation, then the income drawdown moves to 10.61%, and as we know, a drawdown above 4% is unsustainable and will lead to capital depletion. Do you see where I am headed with this? Let’s take it further.

If the rand depreciated to R19.00 after a year, which it didn’t, the current portfolio would still be down by 23% from its 2020 start value, even if it returned 10% annually. It’s nearly impossible to recover from such a situation.

The situation mentioned above is not limited to 2020. Since 2001, the rand’s value has fallen to all-time lows, only to recover by more than 25% from those lows at least four times. Ironically, these were also when a significant amount of funds left the country for better investment opportunities offshore. Unfortunately, every time this happened, there were financial casualties.

Read the implications of the sequence of returns in my previous articles. If you get this wrong, recovery is all but impossible.

Read: The two realities that destroy wealth during retirement

Having said all the above, I want to draw your attention back to my previous articles and the following graph (The below is copied from here):

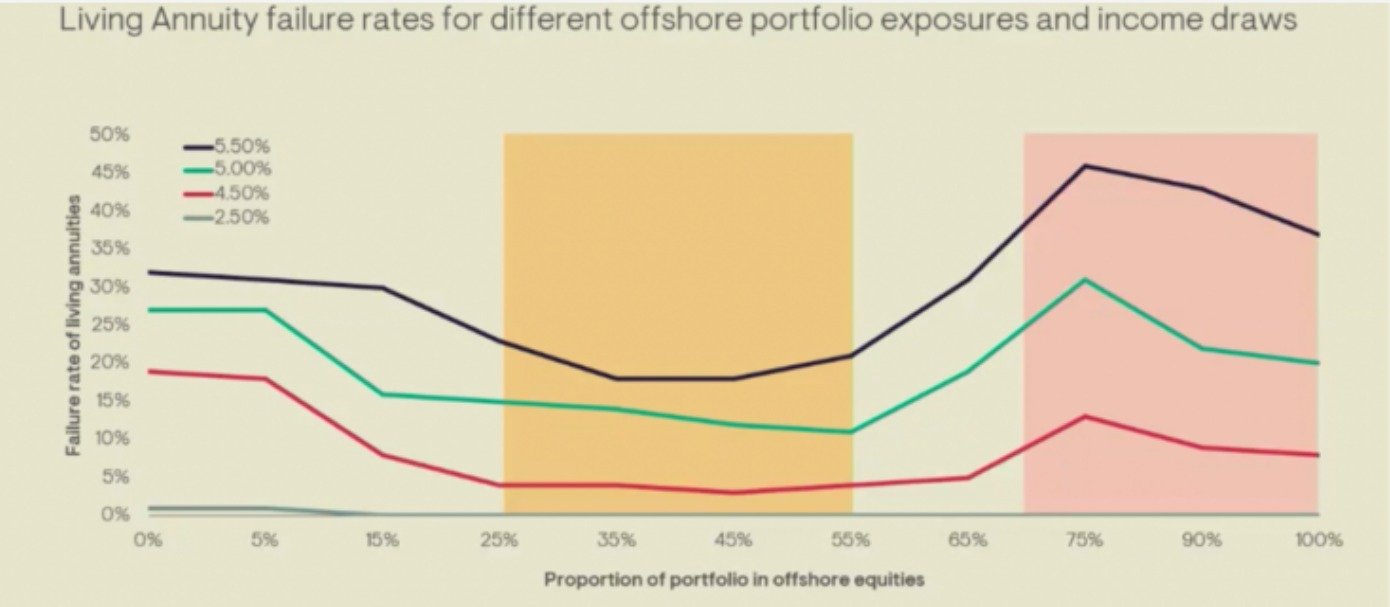

Living annuities failure rates for different offshore portfolio exposures and income draws

The graph above was constructed by Ninety One, which used historical data and considered long-term trends of market movements (local and global) and rand characteristics. The graph indicates the risk of increased failure rates of living annuities as offshore equity exposure increases while income in rand is drawn against a portfolio.

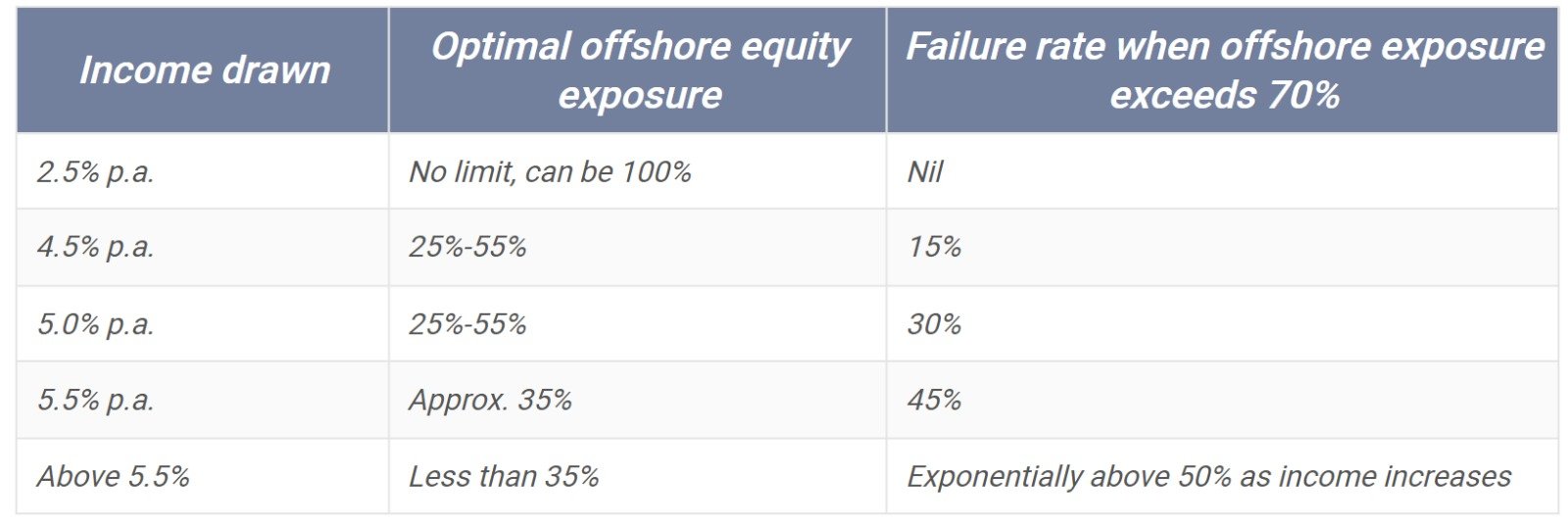

From the above, the following conclusion can be made: (In my opinion)

It is important to note that the above exercise considered only offshore equities. Since offshore equities have historically provided the best asset class returns, the results are even more optimistic than they would be in a balanced portfolio.

This is not because offshore assets are bad but because the rand is one of the most volatile currencies on the planet. The more you expose yourself to that volatility, the worse your outcome may be when you draw income against the investment, especially when the rand strengthens. I am not forecasting a strengthening rand; I am merely commenting.

No problem with 100% exposure in a living annuity

From the above table, it is clear that I have no problem taking 100% offshore exposure in a living annuity if you are drawing 2.5% per annum. Still, we know that, unfortunately, the average drawdown rate in SA is substantially higher than 2.5% and therein lies the risk.

If you draw a high percentage of income (above 5% per year) and you invest during a time when the rand is undervalued, you run a substantial risk of incurring severe losses.

On the flip side, taking 100% offshore exposure with your voluntary investments should be perfectly fine as long as the intention of the investment is long-term and the underlying assets are bought for fundamentally correct reasons and at the right price. Should you decide to invest your voluntary funds offshore, it makes much more sense to invest directly offshore in hard currency than via SA feeder funds from a taxation perspective. Direct offshore funds are more tax-efficient since no capital gains tax (CGT) is levied on rand depreciation, whereas CGT is levied on rand depreciation in feeder funds.

When to consider investing offshore

I always tell clients that when they consider investing offshore, it must be for reasons other than just rand depreciation. Long-term rand depreciation should only account for roughly 25% of the reasons for investing offshore. There are many more prudent reasons to invest offshore. However, when you draw income against an offshore bias portfolio, rand valuation becomes much more important because drawdowns start immediately, and portfolio recovery from an appreciating rand becomes a massive challenge.

All the hype about offshore versus local always surfaces when uncertainty comes to the fore and emotions are high. Be careful that news articles, prophets of doom, elections, politics, and life in general don’t play mind games with you that can be to your detriment.

Invest prudently. Don’t let emotions drive your investment decisions.