THE SIX TYPES OF WEALTH – PART 5: FINANCIAL WEALTH

What is your definition of enough?

As humans, we are driven by an obsession to constantly seek more. D. Rockefeller was once asked by a journalist how much money was enough; he replied, “Just a little bit more”. This pursuit of always wanting more is not restricted to those who fall short or face financial hardship. The wealthy and ultra-wealthy share the same (if not greater) drive to acquire more. No financial gain ever truly satisfies.

Your current definition of “more” becomes your future definition of “not enough” as you set your sights on the next level that you convince yourself will bring happiness and contentment. I see it in my life and in the lives of those around me. That thing you once longed for becomes the thing you can’t wait to upgrade…

Wealth is not measured by a man’s possessions; it is defined by what he is content with. As I mentioned in a previous article, money does not buy or guarantee happiness. This becomes clear when considering that among the world’s 10 wealthiest individuals, there have been 12 divorces among them. That was a fact in 2024; it may have worsened since then.

Many cases exist where wealthy and very wealthy individuals have lost everything due to taking extreme risks in their pursuit of “getting more”.

It is time to define and embrace your “enough.” Live your financial life on your terms, not according to what society expects or the hunter-gatherer habits that so many of us have adopted.

Our challenge is that our pursuit of more is instinctively hardwired. To shift our mindset, we first need to bring “enough” from our subconscious into our conscious mind.

Importantly, your “enough life” doesn’t have to be simple or austere; it can be as luxurious as you desire. It is your “enough” life, and nobody else’s. Define it, write it down, and keep it at the forefront of your thoughts. Once this is accomplished, you can begin building Financial Wealth through income generation, expense management, and long-term investing until it supports that “enough” life you’ve defined.

Be cautious not to fall into the trap of constantly shifting the goalposts or setting the next material target after achieving your initial one. While it’s natural, it’s a risky game. Remember, if you’re not enough without it, you will never be enough with it.

Once you have reached the point where you have enough in life and no longer need to focus solely on money, shift your goals towards balancing your energy to achieve a more fulfilled life by also prioritising time, relationships, purpose, growth, and health. Work on harmonising your six types of Wealth.

The three pillars of Financial Wealth

Dr Thomas Stanley co-authored the book The Millionaire Next Door, which has sold over three million copies and continues to be popular. In it, he states that you do not need a high-paying job, own a business, or receive a large inheritance to achieve financial wealth. He argues that it can be attained by following a set of basic financial principles. It dispels the idea that all the wealthy live in gated mansions with luxury foreign cars and instead shows that a millionaire could be living right next door. While some of the specific strategies in the book may be questionable, the idea that anyone can build financial wealth is empowering. Let this idea be your foundation as Sahil Bloom (The author of The 5 Types of Wealth) constructs a simple model for the path that anyone can follow.

Financial Wealth is built on Three Pillars:

Income Generation: Establish reliable, growing income through primary employment, secondary work, and passive sources.

Expense Management: Maintain expenses consistently below your income and ensure they increase at a slower rate.

Long-Term Investment: Invest the difference between your income and expenses in sustainable, low-cost assets that compound effectively.

Income Generation and Expense Management

The goal is to turn short-term net cash flow into long-term wealth.

Income – Expenses = Surplus, which will form the foundation of your financial wealth. The larger the gap or surplus, the greater the asset base available for investment and compounding.

You can reduce expenses only so far, but you can increase your income indefinitely. Consider the following basic income engine:

Develop skills that are marketable, can be built upon, and have the potential to compound. Each new skill enhances your existing abilities to create a distinctive portfolio.

Utilise skills by strategically applying marketable abilities to generate income. This can range from low-risk time-for-money services to high-risk self-employment and entrepreneurship or acquiring assets that deliver annuity income streams.

Control expenses to stay comfortably within your means. This doesn’t mean sacrificing everything or adopting a Spartan lifestyle, but rather living within a defined budget.

Plan your monthly expenses and track your performance against them.

Automate savings.

Have an emergency fund.

Be mindful of lifestyle creep (inflationary impact of a “higher lifestyle”) also referred to as expectation inflation.

Your expenses should never grow at the same rate as your income. Your “savings surplus” must always increase.

Those who are willing to live below their means in their early years are very likely to reap rewards in the future.

Long-term investment: Compounding the Gap

The first rule of compounding: Never interrupt it unnecessarily (Charlie Munger)

Benjamin Franklin summarised compound interest in his characteristic style: “Money makes money, and the money that money makes, makes money”.

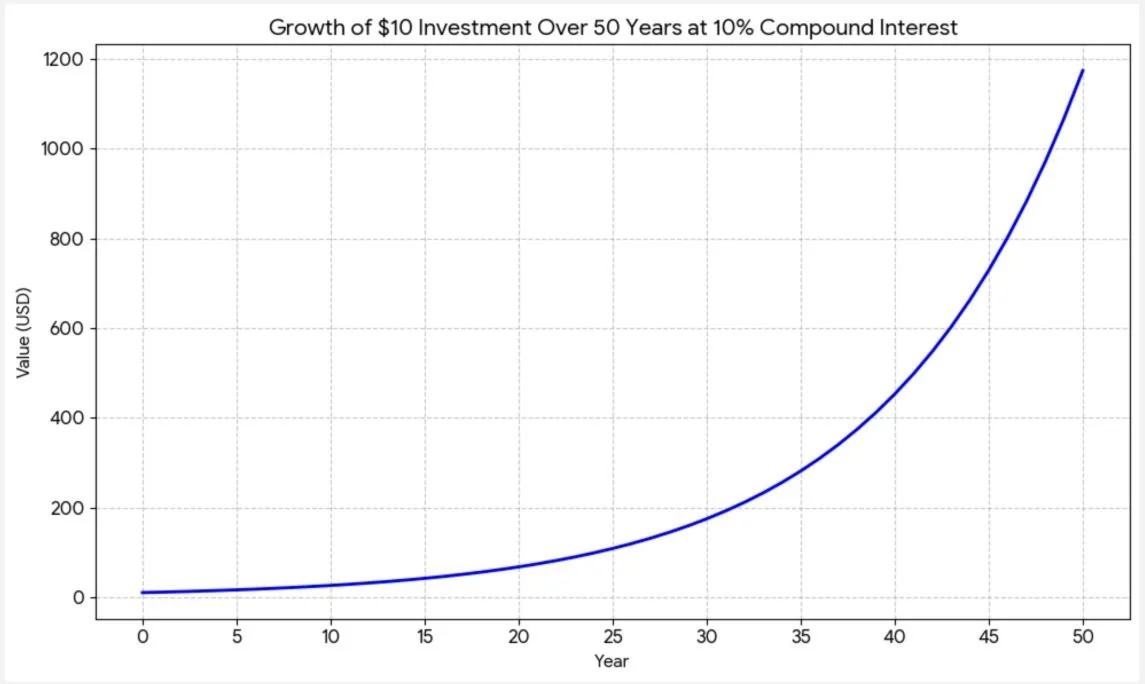

The long-term effect is that compounding has an escalating effect, and the longer it remains in place, the faster it grows. If we plot a compound interest graph, the first couple of years show boring growth with a rather flat profile. The initial growth is slow, then accelerates exponentially.

Everyone knows Warren Buffett. He famously studied under Benjamin Graham, where he developed his investment philosophy centred on intrinsic value, margin of safety, and most importantly, the power of compounding. Warren Buffett accumulated considerable wealth, with a net worth exceeding USD 130 billion. Most of his wealth was amassed after he turned sixty. When we trace his wealth journey, it took Warren 32 years to earn his first USD 1 billion, and 37 years to earn his next USD 129 billion.

Given that we are not all Warren Buffett, the compounding graph above applies to everyone. The lesson is straightforward: Time, not average annual returns, is the most important factor.

Many might now say, “But we do not have 30 or 50 years to invest, so all the above is irrelevant”. To that, I can only paraphrase a well-known proverb: The best time to start was twenty years ago, the second-best time is today.

The five levels of Financial Wealth

There are five distinct levels to the Financial Wealth journey:

Level 1: Baseline needs are met, including food and shelter

Level 2: Baseline needs are exceeded and modest pleasures become accessible. This includes dining out, basic holidays and education expenses.

Level 3: Baseline needs are no longer top of mind. Focus shifts to investing and building wealth.

Level 4: Most reasonable pleasures are readily available. Wealth accumulation accelerates, assets grow and begin to generate passive income (i.e. rental property, dividends, royalties)

This marks the beginning of moderate financial dependence as you become less reliant on your active income while maintaining your lifestyle.

Level 5: All pleasures are accessible. Assets produce passive income that exceeds all expenses.

This is the level of complete financial independence when you can remove all active income and continue to live the same lifestyle.

There is no fixed starting point; each individual begins their journey as their circumstances and needs permit. The one constant is that the process demands discipline and focus on the three pillars of income generation.

Each level presents its own problems and challenges. Some say the more money you have, the more problems you face. I believe that it is not “more money” itself that causes the issue, but the increased risk that comes with wanting more and taking on greater risks.

Note: Financial Wealth does not solve your problems; it merely shifts the types of problems you face. The most vital and fundamental questions about your life will remain, regardless of the level you attain.

It is entirely your choice how to use the Financial Wealth you’ve built to develop and expand other types of wealth – Time, Social, Mental, Physical, and Spiritual – as you aim to create a fully prosperous life.